Good morning, nut fam 🌰 — Hollywood is bracing for its messiest crossover event yet, IBM is suddenly acting like a startup with a credit card, and rents are doing their own horror reboot. Let’s crack it open 👇

🏭 Business Nuts

🎥 Trump Predictably Enters the Netflix–Warner Bros Merger Chat

Hollywood drama meets D.C. drama — what could go wrong?

When Netflix slapped a $72 billion bid on Warner Bros Discovery ($WBD), everyone expected a sequel. Now Trump has confirmed it — announcing he’ll “be involved” in whether the deal passes.

And suddenly, the whole entertainment industry feels like it’s sitting front row at a political table read.

🍿 Why This Deal Is Such a Fireball

If approved, Netflix would gain control of:

DC Comics

Harry Potter adjacent rights

Looney Tunes

Friends, The Sopranos, Game of Thrones

…and thousands of studio workers and IP assets

That alone is enough to melt TikTok’s servers.

But here’s the twist:

The deal blasts straight through the Ellison family storyline.

David Ellison’s Skydance spent a year trying to merge with Paramount — with Trump’s implicit support.

Netflix swooping in for WBD not only undermines that new Hollywood power-broker position…

but also raises antitrust alarms inside Trump’s circle.

So now? Trump is hinting he might be the one to decide whether Netflix becomes the next Disney… or gets blocked like an ex on Instagram.

🟢 Bottom Line: This is no longer just a merger — it’s a political show with a Hollywood budget.

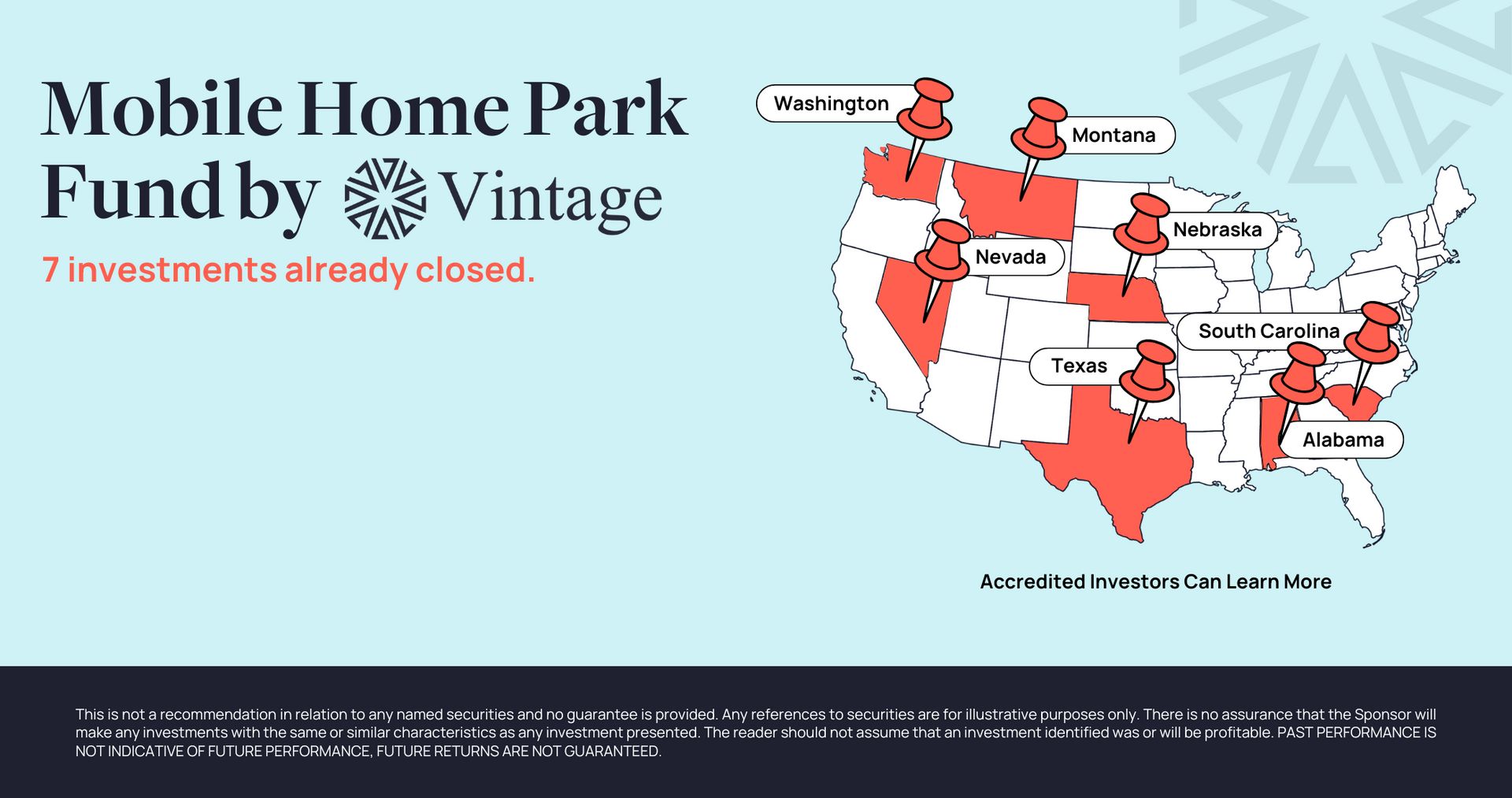

Invest in recession-resilient Mobile Home Parks with Vintage Capital

Invest in recession-resilient Mobile Home Parks with Vintage Capital. Invest direct or in a fund of 20+ underlying assets. 1031s are also available. Access stable, income-generating properties with consistent demand and low tenant turnover.

Now is the time to act: Current market conditions are creating opportunities to acquire properties at attractive valuations.

Our fund targets a 15%-17% IRR and makes monthly distributions, which provides a steady income stream alongside strong upside potential and tax-efficient benefits.

Why Mobile Home Parks?

Recession-Resilient: Affordable housing demand drives stable returns in any economy

High Tenant Retention: The average MHP tenant stays 10-12 years (compared to 2-3 in Multifamily)

Proven Expertise: $100MM+ track record in mobile home park investments.

Tax-Smart Investing: Bonus depreciation offers tax advantages.

🛠️ Tech Nuts

🧵 IBM Goes Shopping for AI Plumbing

Big Blue hits the M&A espresso machine.

IBM circling Confluent for $11 billion feels like watching the quiet accountant at the office holiday party suddenly yell, “I’m entering my disruptive era.”

And honestly?

It tracks.

Confluent runs the real-time data pipelines that feed AI models. Whoever controls that plumbing… controls the water.

⚙️ IBM’s Reinvention Arc

In the last year:

It bought HashiCorp

Cut staff under “AI efficiency”

Flashed quantum hardware no one knows how to use

Watched Google and Microsoft hog all the AI headlines

So yes, IBM is overdue for a bold move.

Buying Confluent would give it the infrastructure credibility it desperately needs — the boring-but-critical backbone that keeps AI online.

Right now, tech M&A looks like a billionaire flea market, and IBM just realized it needs something shiny at its booth.

🟣 Bottom Line: IBM isn’t trying to be cool. It’s trying to be essential. And that might be the smarter play.

📰 Other News — Quick Bites

🏘️ Rents surge 41% since 2020 — One-bedroom units in major U.S. cities now average $1,580, with NYC, San Diego, and Miami seeing jumps as high as $854.

📈 Dow Theory flashes bullish — The Dow Transportation Index climbed for nine straight days, signaling strong market momentum, even as Nvidia ($NVDA) dropped 13%.

💻 Foxconn rides AI server wave — November revenue hit $27B, fueled by demand from Nvidia and Apple. Shares are up 26% YTD after a massive 76% gain in 2024.

👙 Victoria’s Secret finds a pulse — Sales rose 9%, doubling expectations, pushing shares up 11.7%, despite a $37M net loss.

📱 Smartphone prices are set to jump — Memory component shortages are driving prices up 8–10%, especially for budget Android phones. Average smartphone cost expected to hit $465.

🌰 That’s a Wrap

Netflix’s mega-merger drama just got presidential, IBM wants to become the unseen power behind the AI curtain, and rents are still doing rent things (terrifying ones).

Thanks for cracking open Cash Nut today — where the markets stay crunchy and the takes stay fresh 🌰

Catch you tomorrow,

Team Cash Nut 💰