Hey money minds ☕

Today’s menu: crypto dreams vs. math, SpaceX eats its sibling, India rolls out a tax red carpet, and Disney finally picks a new mouse-in-charge. Let’s crack today’s nut. 👇

━━━━━━━━━━━━━━━━━━

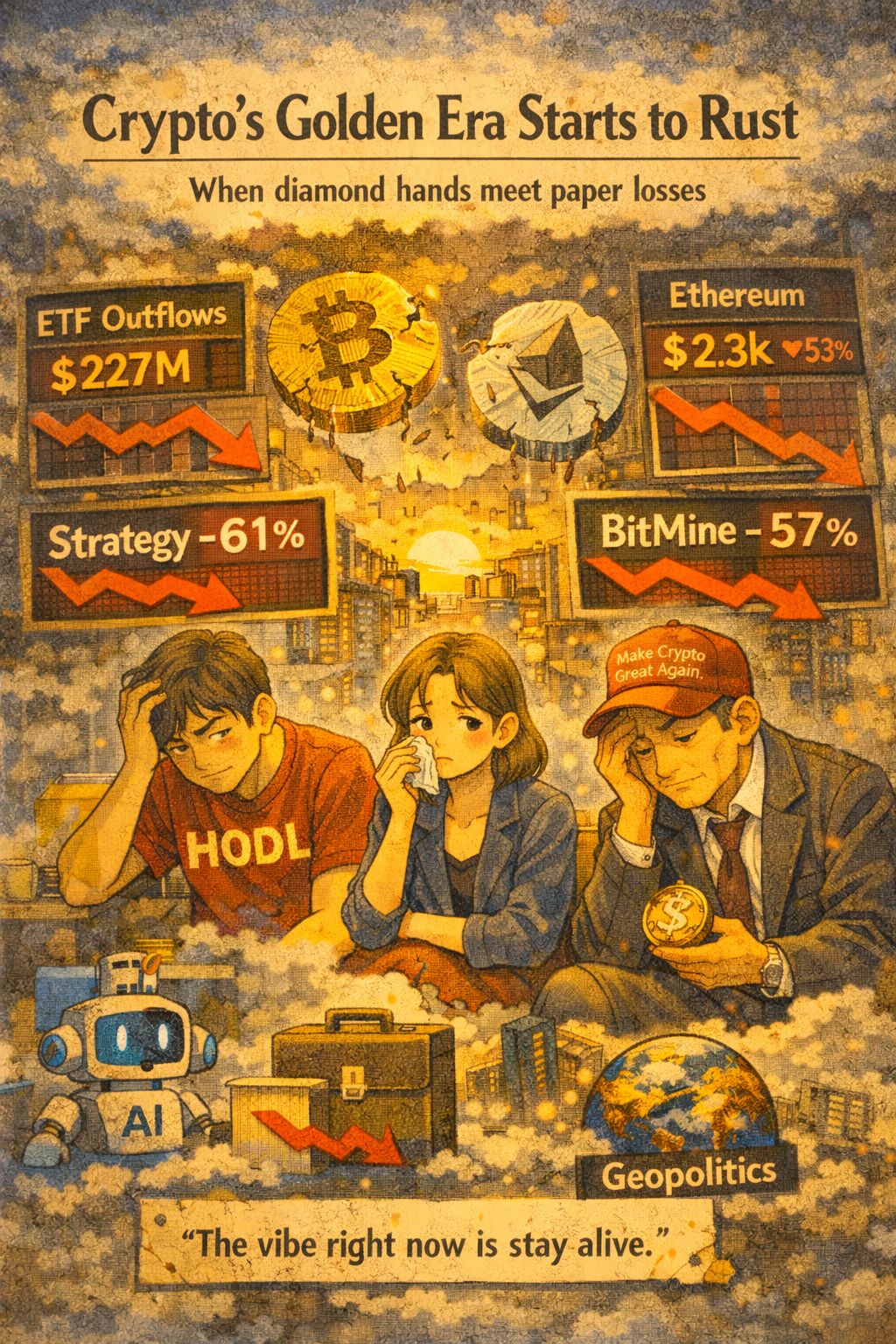

🪙 Crypto’s Golden Era Starts to Rust

When diamond hands meet paper losses

Bitcoin’s post-peak hangover is here — and it’s not subtle.

After smashing records in Oct 2025, Bitcoin has now lost about one-third of its value, dragging retail investors into a group therapy session. The “Trump + ETFs = moon” thesis? Turns out… markets still care about fundamentals.

📉 The vibes:

$227M pulled from spot Bitcoin ETFs by Jan. 28

Bitcoin: ~$76K, down nearly 40% from its peak

Ethereum: ~$2.3K, down 53% from last summer

Strategy ($MSTR): -61% since BTC’s high

BitMine ($BMNR): -57%

Investors are fleeing risk as:

✔️ AI steals capital

✔️ Job market softens

✔️ Geopolitical fear rises

One trader summed it up best:

“The vibe right now is stay alive.”

🧺 The Hoarding Model Hits a Wall

When stacking coins stops stacking gains

Crypto’s favorite play — issuing stock and debt to hoard tokens — is cracking.

Strategy’s premium to its bitcoin holdings (mNAV):

📉 Fell from 2+ to barely above 1

If it dips below 1, Strategy may be forced to sell bitcoin to buy back shares — the one thing Michael Saylor swore would never happen.

🧾 The damage:

Strategy booked $17.44B unrealized loss (Q4 2025)

Still holds 700K+ bitcoins

Bought 855 BTC last week at ~$88K

BitMine holds $16.4B in ETH, still adding despite losses

Two Prime CEO Alex Blume says this model is now “largely dead” for anyone without real operating businesses.

🟢 Bottom Line:

Crypto accumulation only works when prices rise and investors overpay. Right now? Neither is happening.

Together with Percent

Why Wait Years for Returns? Private Credit Can Pay Monthly.

High yield used to mean locking up your money for years. With Percent, accredited investors can access private credit deals that pay monthly - with average durations under 10 months and potential yields up to 20%.

In volatile markets, control matters. Percent empowers accredited investors to take the reins, allowing you to browse curated offerings and choose deals that match your yield goals, time horizon, and risk appetite. Take charge of your portfolio’s risk-return profile.

[Newsletter Name] readers who sign up can get up to a $500 bonus on their first investment.

🗞️ Other News — Rapid Fire Round

Because chaos never sleeps

🚀 Musk merges SpaceX and xAI

SpaceX will acquire xAI (which owns X/Twitter), creating a combined empire worth ~$1.25T. Tesla? Down ~1% on the news.

🇮🇳 India drops a 21-year tax holiday for data centers

Foreign tech firms using Indian data centers get zero tax until 2047. That’s not a policy — that’s a love letter.

🛂 TSA adds a “no Real ID” tax

Travelers without Real ID or passport now pay $45 for TSA ConfirmID and wait 10–30 extra minutes.

🏭 US factories finally wake up

Manufacturing PMI hit 52.6, highest in 12 months as firms restock and prep for tariffs.

⚡ Hubbell rides the AI power boom

Revenue up 11.9% as data centers buy wiring and lighting like it’s Black Friday.

📺 Fubo trims losses after Disney deal

Now at 6.2M subscribers post Hulu + Live TV merger, revenue up 40%.

🐭 Disney picks a new CEO (not named Bob)

Josh D’Amaro takes over March 18. Theme parks now Disney’s biggest profit engine at $10B last quarter.

📵 Spain bans social media for teens

Under-16s locked out next week. France and others watching closely.

💡What else are we reading and seeing?

Data centers in space makes no sense

VC-Backed Startups are Low Status

Microsoft's Pivotal AI Product Is Running Into Big Problems

In Surprising Move, HP CEO Steps Down to Lead PayPal

Anthropic Performance Team Take-Home for Dummies

AV Rideshare Fleet Sizing: Why the Optimum is Just Shy of Peak

1.6 million AI bots are on Moltbook — here's how to join as a human

Sam Altman Reveals Why OpenAI Is Poised To Make The Biggest Business Bets Ever

🧠 The Big Picture

Crypto’s crash isn’t just about price — it’s about psychology.

The dream was politics + ETFs = infinite upside.

Reality says: supply, demand, and risk still win.

Meanwhile:

✔️ AI is sucking up capital

✔️ Governments are reshaping tech

✔️ Media and space are merging

✔️ Teens are getting unplugged

Markets aren’t dying — they’re re-pricing the future.

━━━━━━━━━━━━━━━━━━

Thanks for reading Cash Nut 🥜

If today’s issue saved you from emotional investing, forward it to a friend who still thinks “hodl” is a retirement plan.

See you in the next one 💛

Unlock Amazon Prime Perks You Never Knew Existed

Amazon Prime offers much more than just free shipping! Ensure you're getting the most out of your membership with help from our deal experts. Discover 9 Prime benefits you should be using.